Many technical positives for Peregrine Diamonds recently.

Golden Cross (50 Day moving average crossing over the 200 day moving average).

Update - May 1st - The pattern is still in effect. The trading is within the handle range and has been for a few days. It reached about 26 cents and has traded between 30 and 37 cents the last couple of days.

There is a very distinct cup and handle formation happening right now as well.

A description online can be found here -- cup and handle description

"As

the stock comes up to test the old highs, the stock will

incur selling pressure by the people who bought at or

near the old high" - Check

"The

handle is generally about 5% below the old high point." - Check

"This selling pressure will make the

stock price drift in a sideways fashion with a bias to

the downside for about 4 days to 3 weeks" - 4 to 8 days into the sideways drift.

New blog website -- https://ekimdiamonds.blogspot.com/ Disclaimer - Information in this current blog is based on information obtained up to mid 2018 and should be considered legacy at this time and should no longer be relied upon.

Monday, April 27, 2015

Friday, April 24, 2015

Golden Cross

In the technical world, the golden cross happens when the 50 day moving average crosses over the 200 day moving average.

Peregrine Diamond's stock is on the verge of achieving this very goal.

The stock has had a very reasonable rally and has consolidated a bit on some weather related news with the Chidliak bulk sample.

The good news is that the drilling on CH-7 is almost completed and a valuation model with CH-7 will be move TFFE material into the inferred category in time for the Preliminary Economic Assessment (PEA).

The much smaller CH-44 may miss the boat with this PEA...but I suspect will be included in a subsequent PFS or FS study.

Each year, more and more work is done at Chidliak and the Value add to the project increases. This spring drilling program is no different. There will be value add in addition to what is already known.

Peregrine Diamond's stock is on the verge of achieving this very goal.

The stock has had a very reasonable rally and has consolidated a bit on some weather related news with the Chidliak bulk sample.

The good news is that the drilling on CH-7 is almost completed and a valuation model with CH-7 will be move TFFE material into the inferred category in time for the Preliminary Economic Assessment (PEA).

The much smaller CH-44 may miss the boat with this PEA...but I suspect will be included in a subsequent PFS or FS study.

Each year, more and more work is done at Chidliak and the Value add to the project increases. This spring drilling program is no different. There will be value add in addition to what is already known.

Thursday, April 23, 2015

Bulk Sample Update

A dedicated weather page for Chidliak has been created -- Weather at Chidliak

This is an available online widget with weather direct from Iqaluit. There was a widget for Chidliak Bay, but that no longer works.

Here are some time lapse videos from Kimmirut, which is about 200 km's SW of Chidliak.

Play 24 hour timelapse | Play 30 day timelapse

This is from an area in Greenland across the ocean from Chidliak

Play 24 hour timelapse | Play 30 day timelapse

Update on weather:

Approaching a bit of 1 degree Celcius weather starting on Sunday for a couple for a few days before returning to well below zero.

Highlighted in red are the pertinent numbers for a spring melt and early closure of program.

Highlighted in green are the positive numbers. eg. Hour of sun is very, very low throughout the warming bit.

Peregrine Diamond is probably going to make a decision to see if they can make it through this stretch and continue on with the program...or they may call it a day and end the bulk sample program.

Update on weather:

It is still looking reasonably well over the next 2 weeks for the LDD to continue as planned.

A bit of snow in the next 2 or 3 days and they may be able to send some bulk samples over the snow trail.

There has been an update on the Bulk sample today -- Bulk Sample Update

As of April 19th, they've collected 470 bags from CH-7. 1 bag equates to about 1 tonne of material.

All, but 100 of these bags has made it to Iqaluit and the 100 bags are currently being sent via air.

There is a plan still to try and get a LDD hole into both CH-6 and CH-44...but only if the winter weather stays around. Any sign of thawing of the ice and the equipment is no longer used.

I suspect this also has to do with the fact that the airstrip is ice based as well.

The key to completing as much as possible of the program is the weather.

Iqaluit is a good spot to monitor for weather. A few days ago, it was calling for up to -2 degrees celcius weather. That has changed for colder weather...which is good news for Chidliak.

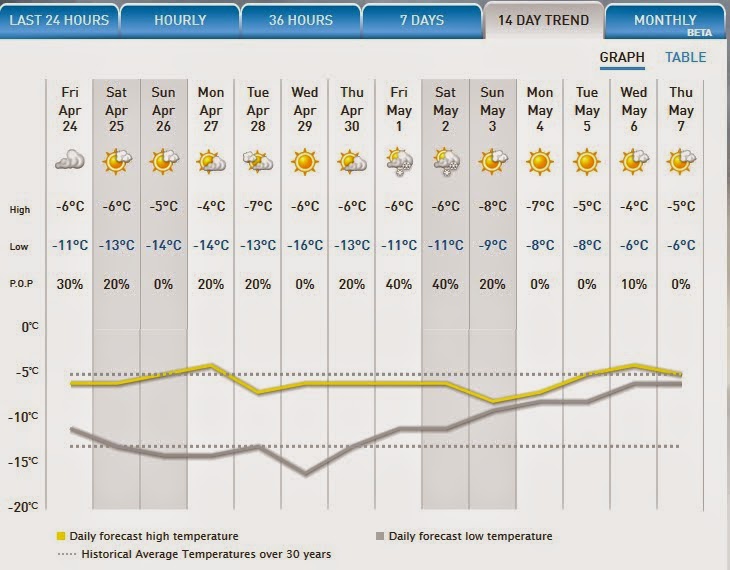

Here is a current long term trend of the weather in Iqaluit:

A bit of snow and colder weather on May 1st/2nd will help...but weather does tend to change quite quickly.

Here is a link to the current 14 day forecast -- Iqaluit weather

This is an available online widget with weather direct from Iqaluit. There was a widget for Chidliak Bay, but that no longer works.

Here are some time lapse videos from Kimmirut, which is about 200 km's SW of Chidliak.

Play 24 hour timelapse | Play 30 day timelapse

This is from an area in Greenland across the ocean from Chidliak

Play 24 hour timelapse | Play 30 day timelapse

Update on weather:

Approaching a bit of 1 degree Celcius weather starting on Sunday for a couple for a few days before returning to well below zero.

Highlighted in red are the pertinent numbers for a spring melt and early closure of program.

Highlighted in green are the positive numbers. eg. Hour of sun is very, very low throughout the warming bit.

Peregrine Diamond is probably going to make a decision to see if they can make it through this stretch and continue on with the program...or they may call it a day and end the bulk sample program.

Update on weather:

It is still looking reasonably well over the next 2 weeks for the LDD to continue as planned.

A bit of snow in the next 2 or 3 days and they may be able to send some bulk samples over the snow trail.

There has been an update on the Bulk sample today -- Bulk Sample Update

As of April 19th, they've collected 470 bags from CH-7. 1 bag equates to about 1 tonne of material.

All, but 100 of these bags has made it to Iqaluit and the 100 bags are currently being sent via air.

There is a plan still to try and get a LDD hole into both CH-6 and CH-44...but only if the winter weather stays around. Any sign of thawing of the ice and the equipment is no longer used.

I suspect this also has to do with the fact that the airstrip is ice based as well.

The key to completing as much as possible of the program is the weather.

Iqaluit is a good spot to monitor for weather. A few days ago, it was calling for up to -2 degrees celcius weather. That has changed for colder weather...which is good news for Chidliak.

Here is a current long term trend of the weather in Iqaluit:

A bit of snow and colder weather on May 1st/2nd will help...but weather does tend to change quite quickly.

Here is a link to the current 14 day forecast -- Iqaluit weather

Wednesday, April 22, 2015

Stock and LDD update

Chidliak is 100% owned by Peregrine Diamonds.

Peregrine has had a recent rally that smacked right into the previous support level.

It has made a couple of attempts recently to get through it, but to no avail.

News from Chidliak may get this through that resistance and the side project in Botswana may help Peregrine Diamonds get more well known and also help the story continue.

There is plenty of cash still available to spend on Chidliak.

The LDD drilling is almost completed as the warmer weather is only a couple weeks out and use of nice solid ice is soon going to be removed.

Latest information is that CH-7 has had the majority of the drilling. CH-6 should get 1 hole. I believe the CH-6 is in the side domain that is in the TFFE category and hasn't had any valuation work completed on it. CH-44 is the trifecta of kimberlites, but is the smaller of the 3 (half the size of CH6 and CH7) and may get missed out for LDD drilling this year. I suspect CH-44 can also get a surface sample done in the future as well as it is not as multi-domained as CH-7.

I suspect a future program may lump the CH-44, CH-45, CH46 together as the three kimberlites are very close together and have the potential of making it to the mine plan.

News should be out on the LDD program and what the next steps are. Whether the 1000 tonnes go directly to Saskatchewan or if they go somewhere else first to get concentrated at a more effective cost.

Botswana deal should be closing soon as well. No news on that as of yet.

Friday, April 17, 2015

1000 percent target

Here is an image from Stornoway's corporate presentation released april 17th, 2015.

The Peregrine Diamond's numbers had a lot of N/A (not available).

Information from this blog has been inserted and you can see the result:

Compared to other diamond plays, Chidliak and Peregrine sit alone in opportunity value.

The Peregrine Diamond's numbers had a lot of N/A (not available).

Information from this blog has been inserted and you can see the result:

Compared to other diamond plays, Chidliak and Peregrine sit alone in opportunity value.

Friday, April 10, 2015

Meat and Potatoes of Diamond Mining

Peregrine Diamonds CH-6 has a significant higher population of macro diamonds compared to world averages.

10% of the macro diamonds at CH-6 are larger than 2 carats in size.

The world average for a kimberlite is only 5%.

CH-6 has double the world average in this regard.

Now compare some photos of rough diamonds from Chidliak (the meat and potatoes) with the final retail product out in a local mall in Canada.

It is not a far stretch that a gem quality, clear white, octahedron diamond from Chidliak in conjunction with an ace diamond cutter...could produce some of the highly prized and expensive diamonds on the retail market.

The largest rough diamond in the photo is 8.87 carats and is worth $US 36,158.

that is uncut. Once cut, you can see where the prices could lead to in the retail market.

Description of that diamond:

8.87 carat sawable, white/colourless transparent octahedron with minor inclusions: US$36,158 (US$4,076 per carat)

For more descriptions on the high quality diamonds at Chidliak, here is the valuation press release from early 2014 -- Valuation Press Release

10% of the macro diamonds at CH-6 are larger than 2 carats in size.

The world average for a kimberlite is only 5%.

CH-6 has double the world average in this regard.

Now compare some photos of rough diamonds from Chidliak (the meat and potatoes) with the final retail product out in a local mall in Canada.

It is not a far stretch that a gem quality, clear white, octahedron diamond from Chidliak in conjunction with an ace diamond cutter...could produce some of the highly prized and expensive diamonds on the retail market.

The largest rough diamond in the photo is 8.87 carats and is worth $US 36,158.

that is uncut. Once cut, you can see where the prices could lead to in the retail market.

Description of that diamond:

8.87 carat sawable, white/colourless transparent octahedron with minor inclusions: US$36,158 (US$4,076 per carat)

For more descriptions on the high quality diamonds at Chidliak, here is the valuation press release from early 2014 -- Valuation Press Release

200 Day Moving Average - Broken through

Significant week with the 200 day moving average pushed through and significant volume over the last couple of days.

Stock has appreciated significantly from the 20 cent range to the 30 cent range.

Robert Friedland did scoop up some of Ned's warrants and owns about 25% of the entire company.

Upcoming news:

Tom is in Iqaluit next week at the annual Nunavut Mining Symposium.

This is a big event and shows the local community the commitment by Peregrine Diamonds at Chidliak and Baffin Island.

Also, next week, there is the closing of the Botswana deal on April 15th.

Key points:

Robert has invested a lot more $$'s into the company.

Over the last 7 months, the company has raised $28.6 million to push the project ahead to and past the PEA level.

Over the last 7 months, the market cap at the bottom was equivalent to $28.7 million.

Those numbers are very similar and when you think the chidliak as a potential $1.5 billion NPV discounted to today, there is a significant amount of value to grow into.

Huge.

Stock has appreciated significantly from the 20 cent range to the 30 cent range.

Robert Friedland did scoop up some of Ned's warrants and owns about 25% of the entire company.

Upcoming news:

Tom is in Iqaluit next week at the annual Nunavut Mining Symposium.

This is a big event and shows the local community the commitment by Peregrine Diamonds at Chidliak and Baffin Island.

Also, next week, there is the closing of the Botswana deal on April 15th.

Key points:

Robert has invested a lot more $$'s into the company.

Over the last 7 months, the company has raised $28.6 million to push the project ahead to and past the PEA level.

Over the last 7 months, the market cap at the bottom was equivalent to $28.7 million.

Those numbers are very similar and when you think the chidliak as a potential $1.5 billion NPV discounted to today, there is a significant amount of value to grow into.

Huge.

Monday, April 6, 2015

Warrants are now halted

The warrants are now halted and will be delisted at end of trading day.

They can still be exercised until 5 pm Eastern time.

Before the warrants were halted, there are 3.6 million warrants for sale at half penny. (strike price 21 cents).

The shares themselves had over 200K shares for sale 22 pennies.

Once the halted was in place, the 200K share ask disappeared.

The only avenue now to purchase shares is on the open market via the shares and the current ask price is 22.5 cents.

We are at inflection point as the 21 cent warrants were an artificial price created by the original rights offering and that artificial nature has now disappeared.

The next few day swill go through some bumps along the way..but in a couple of weeks, the market cap should get back to a more fair value.

They can still be exercised until 5 pm Eastern time.

Before the warrants were halted, there are 3.6 million warrants for sale at half penny. (strike price 21 cents).

The shares themselves had over 200K shares for sale 22 pennies.

Once the halted was in place, the 200K share ask disappeared.

The only avenue now to purchase shares is on the open market via the shares and the current ask price is 22.5 cents.

We are at inflection point as the 21 cent warrants were an artificial price created by the original rights offering and that artificial nature has now disappeared.

The next few day swill go through some bumps along the way..but in a couple of weeks, the market cap should get back to a more fair value.

Friday, April 3, 2015

Friedland's exercise warrants

Very active end of the week for warrant exercising.

Both Robert and Eric exercised their full position adding an additional $6.5 million to the coffers of Peregrine Diamonds.

This money is significant to get Chidliak through to PEA level.

Robert added $3.5 million and Eric added $3 million.

Chidliak could see a $1.5 billion NPV discounted to today's date -- NPV Calculation 2

For a company only worth $55 million and the payback on the mine will be within a couple of years of production...that leaves a lot of potential to grow into from an investment point of view.

With 1000 tonnes of bulk sample material from the 3 pipes...there is a chance we may get to see a fancy diamond. (>10 carats).

to date 450 tonnes of previous bulk samples on these trifecta of pipes yielded these top stones:

8.87 carats

6.53 carats

5.83 carats

4.62 carats

4.11 carats

May start getting pictures and sizes in the September/October timeframe.

Both Robert and Eric exercised their full position adding an additional $6.5 million to the coffers of Peregrine Diamonds.

This money is significant to get Chidliak through to PEA level.

Robert added $3.5 million and Eric added $3 million.

Chidliak could see a $1.5 billion NPV discounted to today's date -- NPV Calculation 2

For a company only worth $55 million and the payback on the mine will be within a couple of years of production...that leaves a lot of potential to grow into from an investment point of view.

With 1000 tonnes of bulk sample material from the 3 pipes...there is a chance we may get to see a fancy diamond. (>10 carats).

to date 450 tonnes of previous bulk samples on these trifecta of pipes yielded these top stones:

8.87 carats

6.53 carats

5.83 carats

4.62 carats

4.11 carats

May start getting pictures and sizes in the September/October timeframe.

Thursday, April 2, 2015

9 million warrants change hands

Update: Confirmed that Robert Friedland has bought these warrants and fully exercised the warrants.

Significant transfer of warrants happened today.

Ned Goodman has indirect ownership of 8.9 million warrants

Ned is one of the trifecta's, but obviously has some ownership in some of Dundee's accounts.

This exact amount was trading via pure trading today as indicated on stockwatch.

The 4.4 million that Ned has is probably being exercised with his own money.

The 8.9 million has indirect ownership of, he probably has less control over and there may not be funds to cover the warrants...hence, the transaction.

Question at this point is, who purchased the warrants to exercise?

It could have gone directly to Ned or possibly to Robert or Eric. Or possibly another investor.

More information should be available over the next week.

Significant transfer of warrants happened today.

Ned Goodman has indirect ownership of 8.9 million warrants

Ned is one of the trifecta's, but obviously has some ownership in some of Dundee's accounts.

This exact amount was trading via pure trading today as indicated on stockwatch.

The 4.4 million that Ned has is probably being exercised with his own money.

The 8.9 million has indirect ownership of, he probably has less control over and there may not be funds to cover the warrants...hence, the transaction.

Question at this point is, who purchased the warrants to exercise?

It could have gone directly to Ned or possibly to Robert or Eric. Or possibly another investor.

More information should be available over the next week.

Subscribe to:

Posts (Atom)